Electric vehicles (EVs) are becoming increasingly popular in the United States. To encourage more Americans to switch to cleaner, greener vehicles, the government has introduced various subsidies and incentives.

The year 2025 is expected to bring new updates to these programs. Here’s a simple breakdown of the electric car subsidies in the US for 2025.

What is an Electric Car Subsidy?

An electric car subsidy is a financial support offered by the government to reduce the cost of buying or leasing an electric vehicle.

Subsidies aim to make EVs affordable and promote a shift from gas-powered cars to cleaner alternatives.

Highlights of Subsidies for Electric Cars in 2025

The US government provides several incentives for EV buyers. Here’s a summary of the most important ones:

| Incentive | Details | Who Qualifies? |

|---|---|---|

| Federal Tax Credit | Up to $7,500 credit for eligible EVs. | Buyers of EVs meet battery and manufacturer requirements. |

| State Rebates | Varies by state; ranges from $1,000 to $5,000. | Residents who buy or lease a new EV. |

| Charging Station Subsidy | Grants to install EV chargers at home or workplaces. | Individuals and business are setting up charging infrastructure. |

| Low-Income Assistance Programs | Additional subsidies for families with lower incomes. | Buyers meeting income thresholds. |

| EV Fleet Incentives | Discounts for companies switching to electric vehicle fleets. | Businesses purchasing EVs for commercial use. |

Important Factors You Need to Know

Federal EV Tax Credit 2025

The federal tax credit remains one of the largest incentives for EV buyers. In 2025, it will continue to cover a wide range of EV models, including both new and used vehicles. Check with the IRS or your dealership to confirm eligibility.

State-by-State EV Subsidies

States like California, New York, and Colorado are leading the way with generous subsidies. Each state has unique programs, so checking local regulations is important.

EV Charging Incentives

The government is also pushing for more charging stations. Incentives for setting up home chargers or using public infrastructure are a big part of the 2025 plan.

Eligibility for EV Subsidies

Eligibility rules are stricter than before. The focus is on promoting American-made EVs and ensuring batteries meet sustainability standards.

How to Claim Your EV Subsidy in 2025?

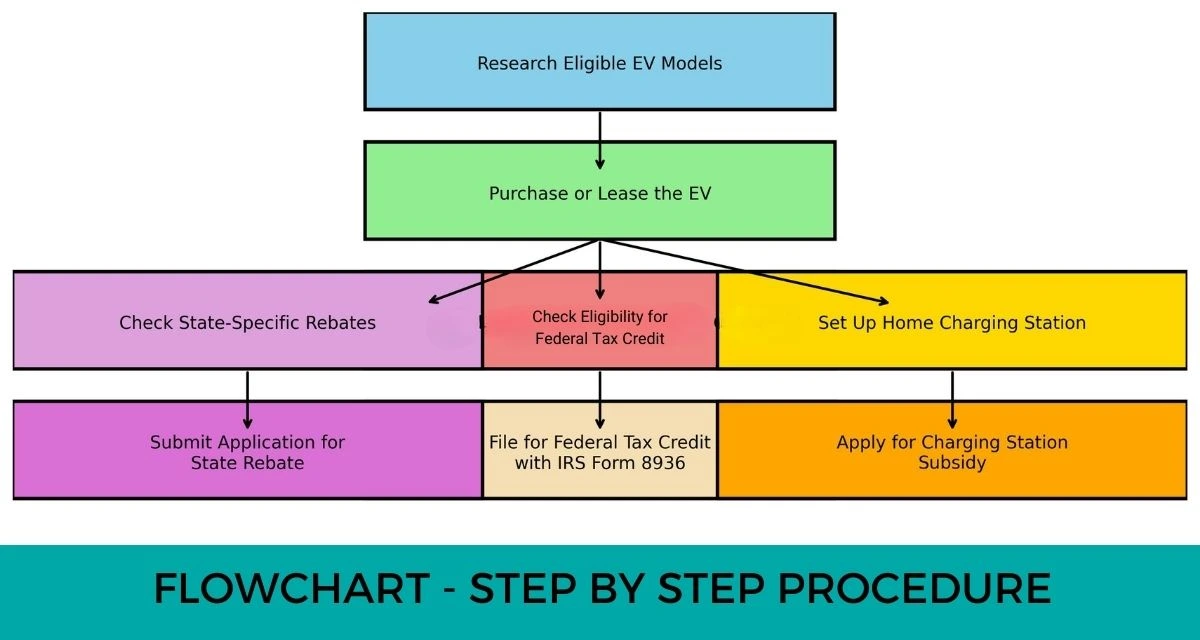

Here’s a step-by-step process to ensure you do not miss out:

1. Research Eligible EV Models:

Start by finding which electric vehicles qualify for federal and state subsidies.

2. Purchase or Lease the EV

Buy or lease the vehicle through an approved dealer.

3. Check Eligibility for Federal Tax Credit

Confirm if the vehicle meets federal guidelines for tax credits.

4. File for Federal Tax Credit

Use IRS Form 8936 to claim the tax credit during your annual tax filing.

5. Check State-Specific Rebates

Visit your state’s official website to learn about additional incentives.

6. Submit State Rebate Application

Apply for the rebate as per your state’s requirements.

7. Set Up Home Charging Station

If you need home charging, install it as per the guidelines.

8. Apply for Charging Station Subsidy

Apply for subsidies to offset the cost of your home charger installation.

Flowchart: Claiming Your Electric Car Subsidy in 2025

Benefits of Electric Car Subsidies

Save money on car costs

Electric car subsidies directly reduce the upfront cost of purchasing or leasing an EV. Federal tax credits, state rebates, and incentives for installing chargers can save buyers thousands of dollars.

For example:

- A federal tax credit of up to $7,500 can make EVs competitive with traditional gas-powered cars.

- States like California and New York offer additional rebates ranging from $1,000 to $5,000, further lowering the cost.

This financial support makes EVs accessible to more people, encouraging widespread adoption.

Reduce Pollution

EVs produce zero tailpipe emissions, unlike gas-powered vehicles that emit harmful pollutants like carbon dioxide (CO2) and nitrogen oxides (NOx). By promoting EVs, subsidies help decrease air pollution, leading to:

- Cleaner air in cities.

- Reduced health risks associated with poor air quality, such as respiratory and cardiovascular diseases.

- A significant reduction in greenhouse gas emissions, mitigating climate change.

- Lower reliance on fossil fuels.

- Drive with peace of mind knowing you’re helping the planet.

Electric car subsidies in the US for 2025 offer significant financial benefits. By taking advantage of these incentives, you can save money while contributing to a cleaner future. Keep an eye on updates and act fast to secure your savings.

Lower Reliance on Fossil Fuels

The US depends heavily on imported fossil fuels, which are both finite and subject to price volatility. Subsidies for electric cars encourage the use of electricity as a fuel source, which:

- Promotes energy independence by reducing reliance on foreign oil.

- Supports the shift to renewable energy sources like solar and wind, which can power EVs sustainably.

Drive with Peace of Mind

Switching to an EV, supported by subsidies, allows individuals to actively participate in protecting the environment. Knowing that your daily commute contributes less to pollution and climate change fosters a sense of responsibility and achievement.

Subsidies also support long-term sustainability by enabling the development of:

- Advanced EV technologies.

- Improved battery recycling processes.

- Broader EV charging infrastructure.

As more people embrace EVs, the collective impact on the planet becomes more significant.

Electric car subsidies in the US for 2025 offer significant financial benefits. By taking advantage of these incentives, you can save money while contributing to a cleaner future. Keep an eye on updates and act fast to secure your savings.

FAQ:

What is the electric car subsidy program in the US for 2025?

In 2025, the subsidy may provide up to $7,500 for qualifying new EVs and $4,000 for pre-owned EVs, depending on the vehicle’s specifications and assembly location.

Who qualifies for the electric car subsidy in 2025?

For new EVs, individuals with a modified adjusted gross income (MAGI) of up to $150,000 (or $300,000 for joint filers) may qualify. Pre-owned EV credits have separate income thresholds.

How do I claim the electric car subsidy for 2025?

Some dealerships may also offer point-of-sale credits, allowing buyers to benefit immediately.